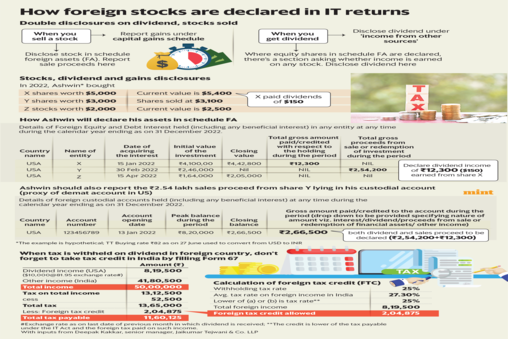

Taxpayers have to mandatorily declare all their foreign assets in the income tax return (ITR) and that includes foreign stocks as well.Even an individual who has a taxable income below the basic exemption limit of 2.5 lakh but holds, say, a Tesla or Apple stock in the US will still need to file the ITR just to disclose this stock holding.

Foreign stocks have to be declared in the ITR every year as long as they are held in your name and not just report the capital gains or losses when you sell them. “Disclosing ownership of foreign assets and reporting income from those assets are two different requirements in the ITR. Both need to be done,” said Suruchi Mahajan, a Bangalore-based chartered accountant and owner, Suruchi & Co. Read More on-

https://www.livemint.com/money/personal-finance/how-to-report-foreign-stocks-in-your-income-tax-returns-11687886370675.html

# Disclaimer- Please note that this Blog has been created with the primary goal of providing its readers with up-to-date information on the Financial Markets. Its purpose is to share knowledge about Financial products, insights from Market experts, recent developments in the financial industry, and business-related information about companies. It is important to emphasize that the Blog should not be interpreted as providing any form of advice. It does not intend to recommend or endorse the buying, selling, or trading of any financial product. The Blog is purely educational in nature.